Record DoorDash Payouts in Your Accounting System

Ever feel like managing your sales and deposits is more complicated than it needs to be? Let’s simplify the process, step by step, so you can get back to doing what you love—running your amazing business! In this example, we are using Quickbooks and Doordash Merchant.

Step 1: POS System to QuickBooks—A Match Made in Heaven 💕

Think of your POS system as your business’s best friend, recording all those daily sales. But to keep your financials in tip-top shape, you need to transfer this information into QuickBooks. This can be done daily or weekly.

Step 2: Recording DoorDash Sales—Easy Peasy 🍕

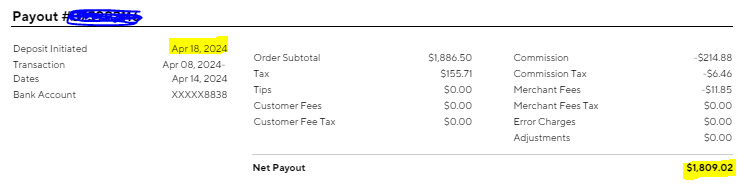

If you’re using DoorDash to boost your sales, they’ll deposit the earnings into your bank account at the end of each week. In QuickBooks, we need to create a deposit that matches what shows up on your bank statement. But before we can do that, we need to record these transactions properly.

Use the Undeposited Funds Account: When DoorDash sales come in, record them in QuickBooks through the Undeposited Funds account. This might sound fancy, but it’s just a temporary holding spot for your money until it hits the bank.

Create the Deposit: At the end of the week or month, when you’re ready to match DoorDash’s deposit, create a deposit in QuickBooks. Here’s the fun part—select all the transactions that happened that week. This is also where you’ll account for any fees DoorDash charges. Simply record these fees under a General Ledger (GL) account called “DoorDash Fees.” 🎉

Click on “ + New “ button and click on “bank deposit”

Sample from Doordash Statement- select all the transactions dated (04/08-04/14)

Then record the fees to an expense account “Doordash Fees”

Match to the Penny: By carefully recording all your transactions and fees, your deposit should match the bank statement to the penny. There’s nothing more satisfying than seeing everything line up perfectly!

Step 3: Double-Check Your Work— 🧐

Finally, make sure both your QuickBooks report and the DoorDash statement match. This might sound tedious, but it’s an essential step to ensure everything is accurate. Your business deserves the best, and keeping your books pristine is a big part of that.

Final Thoughts: Enjoy the Process! 🌟

Bookkeeping doesn’t have to be a chore. With a little organization and the right steps, you can make it a breeze. And remember, every accurate entry is a step toward your business’s success.

And if this all sounds like a bit much, don’t worry! This is exactly the kind of task you can pass on to your bookkeeper. They’re here to help make your life easier and ensure everything is done right. We embrace the process and take pride in our work—it’s a reflection of our dedication and professionalism to our clients.

Click here to fill out our Bookkeeping Services Inquiry Form