Recording Payroll from a Third-Party Provider in QuickBooks Online

When you use a third-party provider to handle payroll, you still need to record the payroll expenses and liabilities in QuickBooks to keep your financial records accurate. This ensures your books reflect the true cost of payroll, including wages, taxes, and any other deductions. Here's a step-by-step guide on how to do it.

Step 1: Get Your Payroll Info

Obtain the payroll summary from your payroll provider. This should show gross wages, taxes withheld, employer taxes, and other deductions.

Step 2: Create a Journal Entry in QuickBooks Online

Open Journal Entry:

Click the "+" icon at the top right.

Select "Journal Entry."

Enter Payroll Expenses:

Gross Wages:

Debit: Payroll Expenses: Gross Wages (total gross wages)

Employee Taxes:

Debit: Payroll Expenses: Employee Taxes (total employee tax deductions)

Employer Taxes:

Debit: Payroll Expenses: Employer Taxes (total employer taxes)

Net Pay:

Credit: Cash/Bank Account (net pay to employees)

Record Liabilities:

Federal Income Tax Withheld:

Credit: Payroll Liabilities: Federal Income Tax

Social Security and Medicare Taxes:

Credit: Payroll Liabilities: Social Security and Medicare

State Income Tax Withheld:

Credit: Payroll Liabilities: State Income Tax

Adjust for Third-Party Payments:

If the provider pays the taxes for you:

Debit: Payroll Liabilities (appropriate categories, like Federal Income Tax, Social Security, Medicare)

Credit: Cash/Bank Account (total paid by the provider)

Example Journal Entry

Payroll summary:

Gross Wages: $10,000

Federal Income Tax Withheld: $1,500

Social Security and Medicare Taxes (Employee): $765

Social Security and Medicare Taxes (Employer): $765

State Income Tax Withheld: $200

Net Pay: $7,535

Journal Entry:

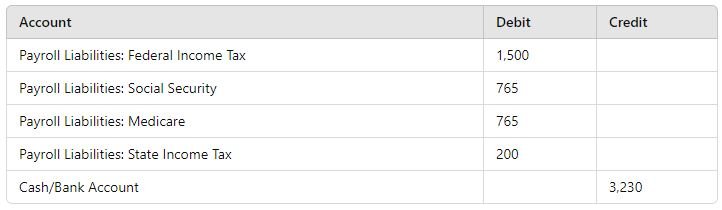

If the third-party provider pays the taxes:

Step 3: Save and Review

Make sure all amounts match your payroll summary.

Click "Save and Close."

Step 4: Reconcile with Bank Statements

Check the journal entries against your bank statements to ensure everything matches.

Account names above were previously created in the chart of accounts and names may differ from your records.

By recording payroll this way, you ensure your QuickBooks reflects all payroll-related transactions, even if a third-party provider handles the payments. This keeps your financial statements accurate and helps you maintain proper records for reporting and tax purposes.

Hiring a bookkeeper for these tasks is definitely worth the money. A professional bookkeeper has the knowledge and experience to handle these complex entries, saving you time and preventing costly mistakes. Plus, your CPA will thank you later!